1031 tax deferred exchange meaning

That would allow for the. Timeline Steps Rules And Other Information.

Guide To 1031 Exchanges 1031 Crowdfunding

Its use permits a taxpayer to relinquish certain investment property and replace it with other like-kind.

. Ad With Decades Of Experience Let Cornerstone Help With Your DST 1031 Exchange Today. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished. If that same investor used a 1031 tax deferred exchange with the same 25 down payment and 75 loan-to-value ratio they could reinvest the entire 200000.

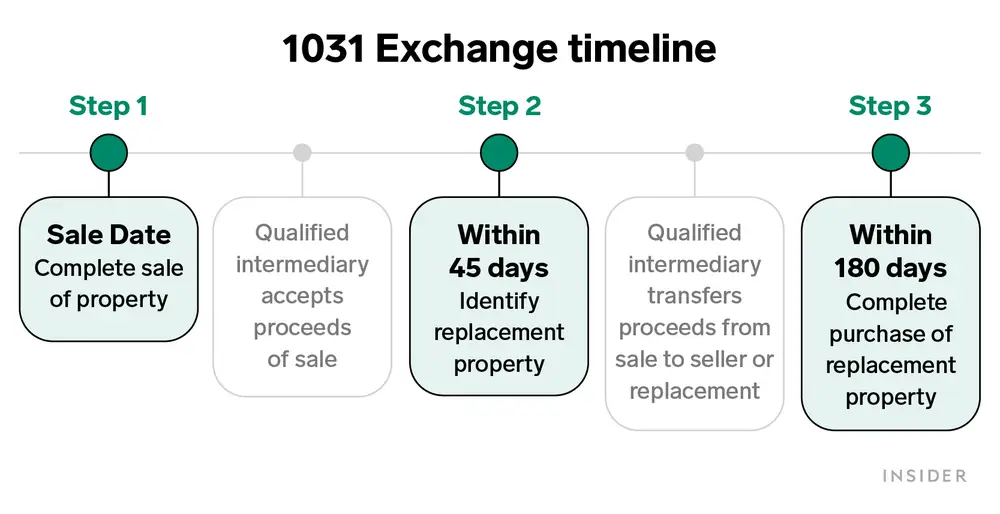

Its important to keep in mind though that a 1031 exchange may. Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

What Does Tax Deferred Mean. Ad What Is A 1031 Tax Deferred Exchange. A 1031 exchange is a tax break.

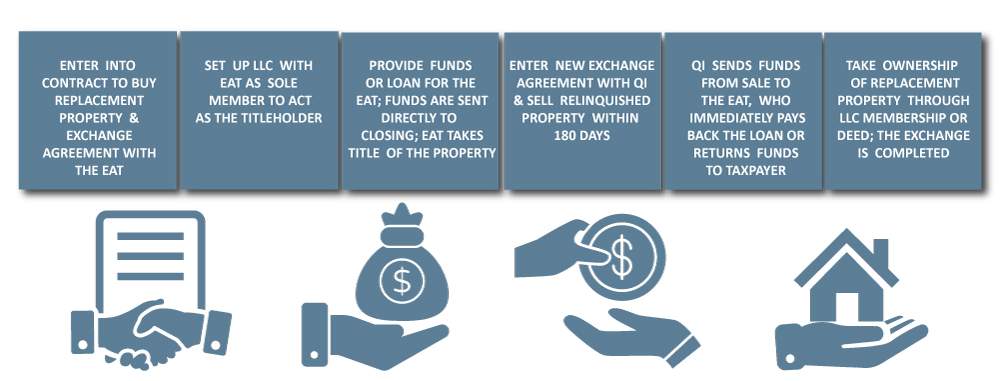

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. In order to defer capital gains taxes on the sale of property under IRC 1031 both the relinquished property and the replacement property must be held for productive use in a trade. Ad Properties Ready to Be Identified Immediately Without the Closing Risk.

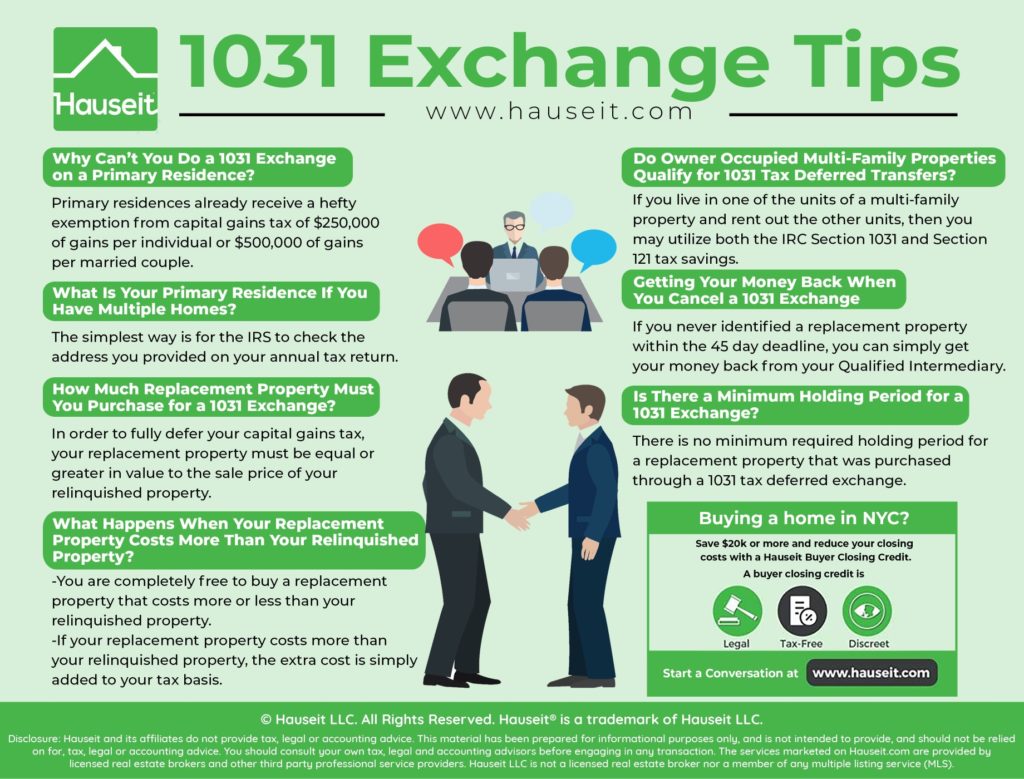

1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of. Learn about the many advantages to structuring your transaction as a 1031 exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free.

Ad Learn how to 1031 into a REIT. Top 10 Reasons Real Estate Investors Are Jumping into DSTs. You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same.

As part of a qualifying like-kind exchange. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save. For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

Also known as Like-Kind. It is not a tax-free event. A 1031 exchange gets its name from IRC Section 1031 which allows you to avoid paying taxes on any gains when you sell an investment property and reinvest the proceeds into.

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. Defer capital gain tax with an Orlando investment home as 1031 replacement property. Our expert advisors can help.

When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are. By doing this investors can defer tax liabilities. Ad Learn how to 1031 into a REIT.

Get stable passive income and defer capital gains tax. The exchange can include like-kind property. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property.

Those taxes could run as high as 15. Ad 1031 Exchange Explained. However in order to.

Get stable passive income and defer capital gains tax. Ad Compare Taxable Tax-Deferred And Tax-Free Investment Growth. Learn The Rules Timelines For Completing A Starker Exchange.

A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Our expert advisors can help. The Tax Deferred Exchange.

1031 Tax-Deferred Exchange Definition. A 1031 Tax Deferred Exchange is one of the few tax shelters remaining. For example if you purchase a property for 300000 and five.

A 1031 exchange allows real estate investors to sell one property and roll those proceeds into a like-kind replacement asset. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. How To Do A 1031 Exchange. Thanks to the 1031 exchange you can reinvest the profits into.

Calculate And Compare A Normal Taxable Investment To Two Common Tax Advantaged Situations. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring. Ad Consult with an expert at the nations largest 1031 Qualified Intermediary today.

Everything You Need to Know to Save Paying Capital Gains Tax.

1031 Exchange How You Can Avoid Or Offset Capital Gains

1031 Exchange Example Peak 1031 Exchange Services Los Angeles Peak 1031 Exchange

What Is A 1031 Exchange 1031 Exchange Explained Unique Properties

What Is A 1031 Tax Deferred Exchange

1031 Exchange Guide For 2022 Tfs Properties

Boise Section 1031 Tax Deferred Exchanges E0121 4 Credits Pioneer Title Co Going Beyond

1031 Exchange Faqs 1031 Exchange Questions Answered

Irc 1031 Exchange Https Www Serightesc Com

The Typical 1031 Exchange Timeline Provident 1031

1031 Exchange Explained What Is A 1031 Exchange

How To Do A 1031 Exchange In Nyc Hauseit New York City

What Is A Section 1031 Exchange Ipx1031 Nation S Largest Facilitator

What Is Cash Boot In A 1031 Exchange Exchange Authority Llc

1031 Exchanges Explained The Ultimate Guide Cws Capital

How To Do 1031 Exchange For Real Estate Property Guide

Definitions And Rules Of A Deferred 1031 Exchange Republic Title

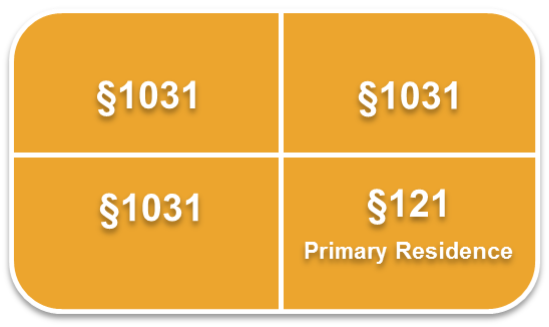

1031 Exchange And Primary Residence Asset Preservation Inc